Bitcoin, however, is a decentralized currency – it’s neither a brand nor a product or company, and what we need for representing Bitcoin is a symbol rather than a logo. Examples of Unicode Character U+0243 in different typefaces. The Ƀ symbol can be displayed in many fonts, some of which may already be installed on your computer.

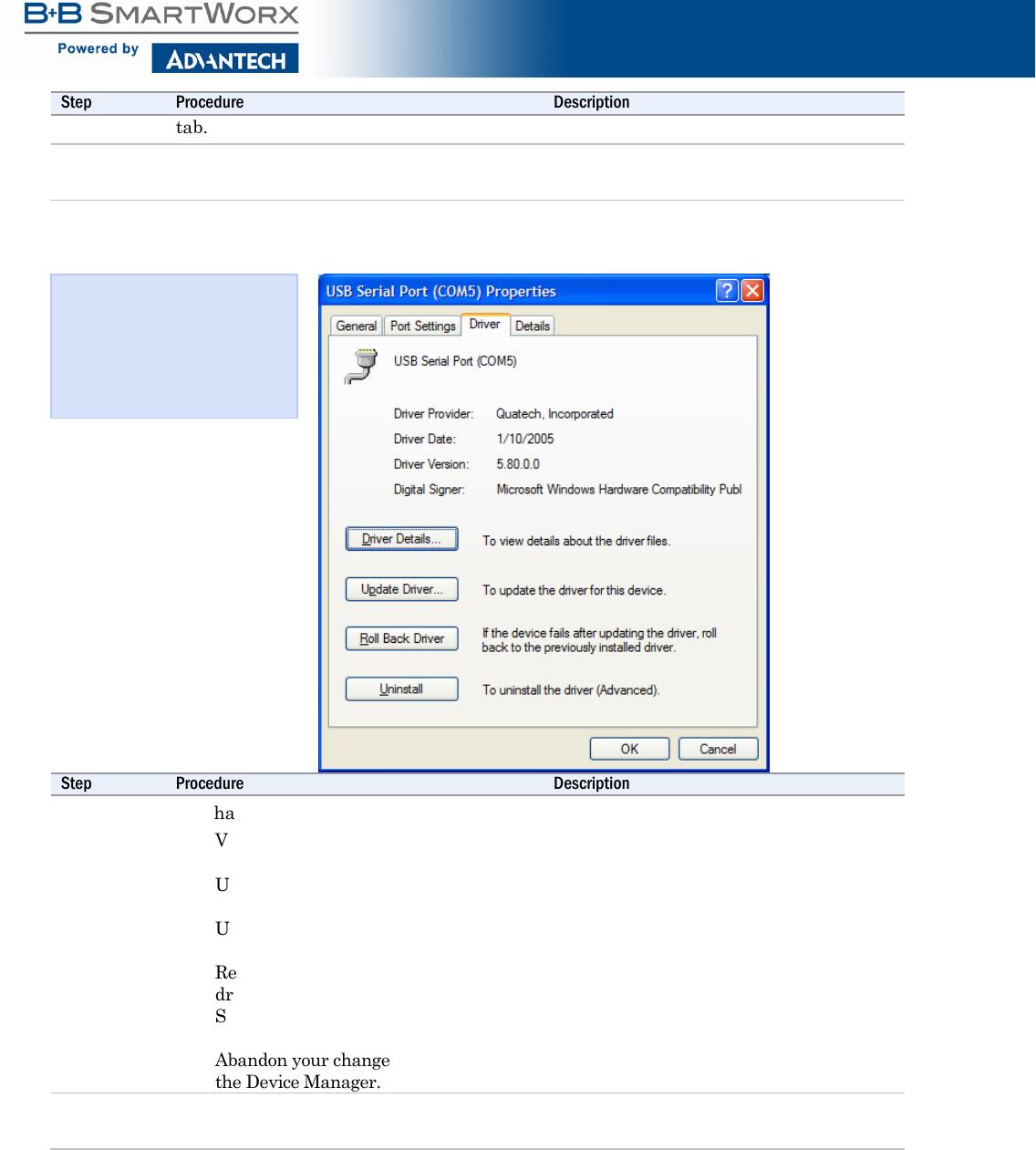

Find the latest Bitcoin CAD (BTC-CAD) stock quote, history, news and other vital information to help you with your stock trading and investing. Update the device driver. In the search box on the taskbar, enter device manager, then select Device Manager. Select a category to see names of devices, then right-click (or press and hold) the one you’d like to update. Select Search automatically for updated driver software. Select Update Driver. Bitcoin, however, is a decentralized currency – it’s neither a brand nor a product or company, and what we need for representing Bitcoin is a symbol rather than a logo. Examples of Unicode Character U+0243 in different typefaces. The Ƀ symbol can be displayed in many fonts, some of which may already be installed on your computer.

Key takeaways

- Digital currencies like Bitcoin are different from traditional forms of payment.

- There are benefits and significant risks associated with digital currencies.

What exactly is Bitcoin, and what are the risks involved in using it as a form of payment or as an investment opportunity? Here are some answers to frequently asked questions:

What is Bitcoin?

Bitcoin is the first and largest asset in the growing category of cryptocurrency (also known as digital currency). It was originally intended as a medium of exchange that is created and held electronically. Bitcoin was the first, but there are hundreds of digital currencies.

We'll focus on Bitcoin here to illustrate how digital currencies work. However, the underlying blockchain technology and functionality of Bitcoin are similar to many of the other widely used digital currencies, including Ethereum, Bitcoin Cash, and Litecoin. (For more on blockchain, see below.)

Who creates Bitcoin?

Bitcoins aren't printed by a government organization like the US Treasury does with dollars. Instead, they're produced by people and businesses running computers all around the world, using software that solves a very complex mathematical problem. The mathematical formula is freely available, so that anyone can check it, but you'll need a really powerful set of computers to solve the problem.

Who controls Bitcoin?

One of the important points is that no single person, entity, or organization controls Bitcoin. The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its appeal for many—but that also makes it harder to understand.

Can I tell who owns Bitcoin?

Bitcoins are sometimes regarded as anonymous. They are stored in digital wallets—essentially electronic vaults—which can have public electronic addresses associated with them. But they aren't necessarily linked to names, home or business addresses, or other personally identifying information. What’s more, you don't need to give your real name or other personal information to make direct transactions on the Bitcoin blockchain; only the digital addresses of the Bitcoin wallets identify the buyer and seller.

How is the value of Bitcoin determined?

Digital currency functions differently from traditional money. The price of a Bitcoin is determined by the supply and demand on the exchanges where it trades, while the buying power of traditional money is influenced by factors such as central bank monetary policy, inflation, and foreign currency exchange rates.

How do you transact with Bitcoin?

Transactions with Bitcoin can be completed without intermediaries like banks or credit card companies. When you transact with Bitcoin, it is essentially a direct transfer between the sender and recipient of the Bitcoins. Transfers can be made online or through a smartphone app—similar to making an electronic transfer with traditional currency.

What are pluses and minuses of transacting with Bitcoin?

For many, the advantages of Bitcoin are fast, anonymous, transparent, and low-cost transactions. But the infrastructure and adoption by businesses to support these transactions is still in the very early stages. Proponents of digital currency think this ability to easily transfer value from person to person throughout the world will inevitably lead to an increase in the use of digital currencies. Alternatively, the hyper-volatility of value and uncertainty of regulation could discourage businesses from accepting digital currencies.

Can I buy cryptocurrencies at Fidelity?

Retail brokerage customers cannot buy or sell any cryptocurrencies at Fidelity. However, those who have a Coinbase digital currency account can arrange to view those balances on Fidelity.com. Although Bitcoin futures are now available for trading on the CBOE and CME, Fidelity does not currently have any plans to offer Bitcoin futures trading for its retail brokerage customers.

Are there costs or commissions to buy and sell Bitcoin?

Some users and holders of digital currencies, such as Bitcoin, have reported having to pay significant transaction-related fees. In most cases, customers who purchase, sell, or transfer Bitcoin will be charged transaction fees by the cryptocurrency exchange (note that there are many exchanges, brokers, and other intermediaries where transaction costs can vary widely), and potentially other fees, like network fees. Every Bitcoin transaction has a network fee that is automatically deducted from the Bitcoins sent, and the amount of the fee varies based on a variety of factors. In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees.

What are some of the risks of investing in Bitcoin?

Some speculators have been drawn to Bitcoin trading as a way to make a quick profit. However, as is the case with most speculative investments, you need to be careful. Buying, selling, and using Bitcoins carry numerous risks. Among them:

- The price of Bitcoin and other digital currencies has fluctuated unpredictably and drastically. You could experience significant and rapid losses. Profits or losses from investing in Bitcoin are virtually impossible to predict.

- Digital currency such as Bitcoin is not legal tender. No law requires companies or individuals to accept Bitcoin as a form of payment. Instead, Bitcoin use is limited to businesses and individuals that are willing to accept Bitcoins.

- Platforms that buy and sell Bitcoins may be unregulated, can be hacked, may stop operating, and some have failed. In addition, like the platforms themselves, digital wallets can be hacked. As a result, consumers can—and have—lost money.

- Bitcoin transactions can be subject to fraud and theft. For example, a fraudster could pose as a Bitcoin exchange, Bitcoin intermediary, or trader in an effort to lure you to send money, which is then stolen.

- Unlike banking institutions that can provide FDIC insurance, there are no such safeguards provided to digital wallets.

- Bitcoin payments are irreversible. Once you complete a transaction, it cannot be reversed. Reversing a transaction depends solely on the willingness of the recipient to do so.

When researching and evaluating a potential investment, investors must decide for themselves whether the investment fits with their time horizon, financial circumstances, tolerance and preference for volatility, and risk of loss. Anyone thinking of investing in Bitcoin or in Bitcoin-related investment opportunities should understand digital assets, do their research, be prepared for significant price gyrations, and proceed with caution.

Have regulators issued any statements on Bitcoin?

Cryptocurrencies have been on regulators' radar for some time. A number of federal and state regulators have issued investor alerts and other statements about Bitcoin, token sales or initial coin offerings (ICOs), and other cryptocurrency-related investments. The Securities and Exchange Commission (SEC) has suspended trading in a number of securities due to questions regarding the accuracy of these companies’ claims of cryptocurrency‐related activities. Right now, the laws and regulations are still developing and it is difficult to predict the eventual legal landscape for digital currencies.

What is blockchain?

Much of the media coverage of digital currency has focused on the fluctuating value of Bitcoin. But what you may not be hearing about is the disruptive power of the technology behind cryptocurrencies, which could have the true staying power. Bitcoin, like many other open coin/token blockchain-based cryptocurrencies, stores details of every single transaction that ever happened in a gigantic general ledger called the blockchain, which is distributed across the internet to all the computers that produce Bitcoin.

There are many more potential applications of blockchain technology. It is essentially a database that does not store information at a single computer server or physical location, compared with traditional information databases. Instead, a blockchain is hosted by all of the computers across the network that store the information. This allows for publicly available and readily verifiable information. That is, it allows for transparency of digital assets, but not personally identifiable information.

Fidelity sees several potential ways that blockchain technology could be impactful:

- Future developments in blockchain could alter financial markets in the same way that the internet did. Just as the internet made sending letters and other information more efficient, blockchain could change the market structure of currencies and perhaps even some aspects of the architecture of the internet itself.

- Blockchain technology has the potential to complement other emerging technologies—including the Internet of Things and artificial intelligence—creating new industries and financial products.

- As blockchain technology evolves, it may provide consumers greater access to some financial services and could give customers more control over their financial data.

Next steps to consider

Find new investing ideas and get up-to-the-minute market data.

Learn what you need to know before trading the market.

Get insights and ideas from Viewpoints.

Some people kill time at the airport by browsing duty-free shops. I decided to shop for bitcoin.

But first, there are two things you should know about me: I tend to be almost as afraid of losing money investing as I am of flying. On some level, I figured one fear might cancel out the other.

So last Thursday, while waiting for a flight to Nashville, I pulled up a popular application called Coinbase that can be used to buy and sell bitcoin. The virtual currency had hit $10,000 for the first time a couple days earlier, before retreating somewhat. News of bitcoin's rapid rise was everywhere, including on CNN.

For 15 minutes at the airport, I refreshed the price of bitcoin over and over, watching as it gained and lost hundreds of dollars in a matter of minutes. I called out the price fluctuations breathlessly to my wife, who gently encouraged me not to be an idiot, before returning to her magazine.

She was in good company. JPMorgan Chase CEO Jamie Dimon recently called bitcoin a 'fraud' and suggested people who buy it are 'stupid.' Warren Buffett called bitcoin a 'mirage' in 2014 and warned investors to 'stay away.'

Are you trading Bitcoin? We want to hear from you.

And yet bitcoin has climbed more than tenfold since Buffett's warning. Earlier this month, one college friend casually told me over drinks he'd made tens of thousands of dollars investing in another cryptocurrency. He said he hoped it would be worth enough one day to buy a house.

When I saw the price of bitcoin fall to $9,500, I pressed buy, defying the wisdom of two finance titans and my wife. One hundred dollars, or 0.0101 bitcoins. (A few days later, I bought another $150.) By the time we got to our hotel, my stake had already gone up 10%. One week later, it was (briefly) up 100%. My wife's opinion of me has reportedly decreased by the same amount.

What is happening?

It's an investing frenzy, plain and simple.

Bitcoin cracked $1,000 on the first day of 2017. By this week, it was up to $12,000, and then it really took off: The price topped $17,000 on some exchanges Thursday, and $18,000 on at least one.Other cryptocurrencies have seen similar spikes, though they trade for much less than bitcoin.

There's a long list of factors people may point to in an attempt to explain this. Regulators have taken a hands-off approach to bitcoin in certain markets. Dozens of new hedge funds have launched this year to trade cryptocurrencies like bitcoin. The Nasdaq and Chicago Mercantile Exchange plan to let investors trade bitcoin futures, which may attract more professional investors.

Yet a key reason the price of bitcoin keeps going up is, well, because it keeps going up. Small investors like yours truly have a fear of missing out on a chance to get rich quick. And when the value of your bitcoin doubles in a week, as it did for me, it's easy to think you're a genius. But you can get burned assuming it will keep skyrocketing.

Some investors have likened the bitcoin hype to the dot-com bubble. Others, like Dimon, have said it's even 'worse' than the Dutch tulip mania from the 1600s, considered one of the most famous bubbles ever.

As Buffettput it back in 2014, 'the idea that [bitcoin] has some huge intrinsic value is just a joke in my view.' Bitcoin is not backed by a company's earnings, or the strength of a government and rule of law. There's also no interest or dividends.

Why would anyone want or need to use bitcoin?

B&h

Bitcoin serves as a new kind of currency for the digital era. It works across international borders and doesn't need to be backed by banks or governments.

Or at least that was the promise when it was created in 2009. The surge and volatility of bitcoin this year may be great for those who invested early, but it undermines bitcoin's viability as a currency.

Right now, I can use my bitcoin holdings to pay for purchases at Overstock(OSTBP), or book a hotel on Expedia(EXPE). But if I use bitcoin to buy $25 worth of socks on Overstock today, and the price of bitcoin quadruples next week, I'll feel like those socks actually cost me $100. Then again, if bitcoin crashes, at least I'll always have the socks.

Rather than a currency, bitcoin is being treated more like an asset, with the hope of reaping great returns in the future.

So is there anything truly valuable about bitcoin?

Yes, the technology behind it.

Bitcoin is built on the blockchain, a public ledger containing all the transaction data from anyone who uses bitcoin. Transactions are added to 'blocks' or the links of code that make up the chain, and each transaction must be recorded on a block.

Even bitcoin critics like Dimon have said they support the use of blockchain technology for tracking payments.

Is there a legal and legitimate way to invest in bitcoin?

B-52

Bitcoin exchanges have a checkered history. Mt.Gox, once the largest exchange, shut down in 2014 after losing hundreds of millions of dollars worth of bitcoin after a hack.

Today, the leading exchange is offered by Coinbase, a startup that has raised more than $200 million from a number of top tier venture capital firms. Square(SQ), the payments service, is also rolling out a bitcoin product.

There are also bitcoin ATMs in scattered bodegas and convenience stores around the country, through companies like Coinsource. The ATMs let you exchange bitcoin for cash, or vice versa by scanning a QR code from the digital wallet application on your phone.

With Coinbase, you must first give the app permission to connect to your bank account. As with other stock trading applications, you pay a small fee for each transaction, buying and selling. But the transaction can take significantly longer.

My original $100 bitcoin purchase won't officially be completed on Coinbase until Friday, more than a week after the transaction. The price I bought it at remains the same, but I won't be able to sell at the earliest until Friday.

B&w Hitches

If the price plummets before then, I'm out of luck. No socks for me.

B&b Port Devices Driver Downloads

-- CNN's Selena Larson contributed to this report.